Part of a multipart series on Busting Investment Myths

Every mutual fund prospectus includes the disclaimer: “Past performance is no guarantee of future results.” This legal requirement has evolved into investment dogma that dismisses all historical analysis as worthless.

This interpretation is both incorrect and counterproductive.

What the Disclaimer Actually Means

The disclaimer warns against assuming that last year’s top-performing fund will be next year’s winner. This type of simple extrapolation—expecting recent results to continue unchanged—does indeed have little predictive value.

But the disclaimer doesn’t invalidate all uses of historical data. Past performance becomes predictive when analyzed systematically across multiple time periods and market conditions.

The Academic Evidence

Decades of academic research document persistent patterns in historical market data:

Momentum effects: Securities with strong recent performance tend to continue outperforming for 3-12 months. This contradicts random walk theory but has been validated across different markets and time periods.

Reversal effects: Very short-term performance (days to weeks) often reverses, while very long-term performance (3-5 years) also tends to reverse. These patterns are statistically significant and economically meaningful.

Risk factor persistence: Exposure to factors like value, momentum, quality, and profitability shows persistence that can be exploited systematically.

Why Simple Extrapolation Fails

Individual performance streaks are random and unreliable. A fund manager’s hot streak or a stock’s recent gains provide little information about future prospects when analyzed in isolation.

The key is aggregating historical patterns across thousands of securities and multiple time periods to identify persistent statistical relationships rather than projecting individual results forward.

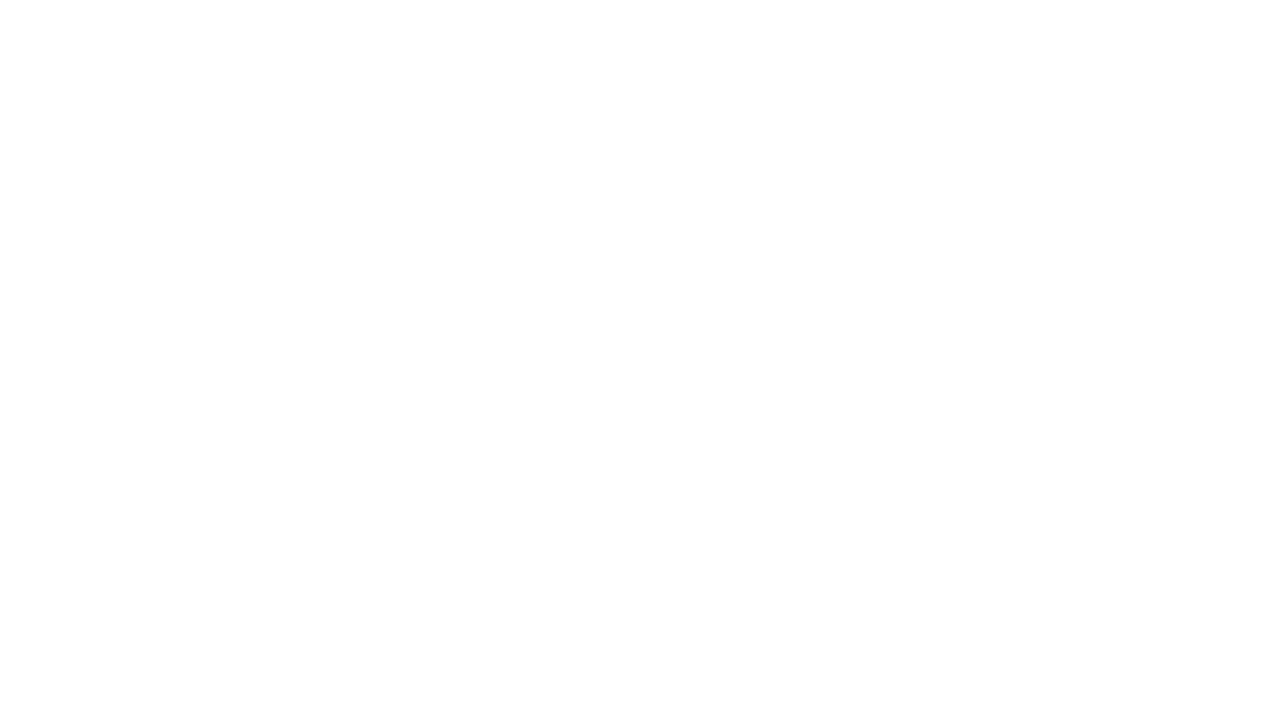

How to Use Past Performance Correctly

Systematic backtesting: Test investment strategies across multiple historical periods to validate their effectiveness across different market conditions.

Pattern recognition: Identify recurring relationships between historical characteristics and future performance that persist across time.

Risk assessment: Use historical volatility and correlation patterns to estimate potential downside scenarios for portfolio construction.

Relative analysis: Compare past performance across similar investments to identify persistent competitive advantages.

The Brockmann Method Application

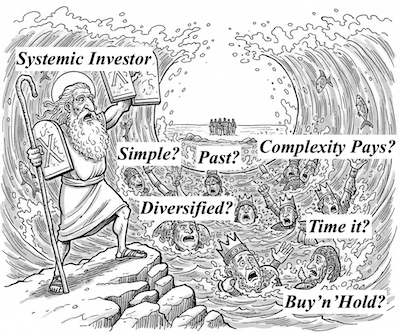

Our approach uses 18 years of backtesting data not to predict specific future returns, but to validate that momentum-based ranking systems consistently outperform random selection and buy-and-hold strategies across different market environments.

The system doesn’t assume past performance will repeat exactly. Instead, it exploits the persistent tendency for relative strength to continue in the near term—a pattern documented extensively in academic literature.

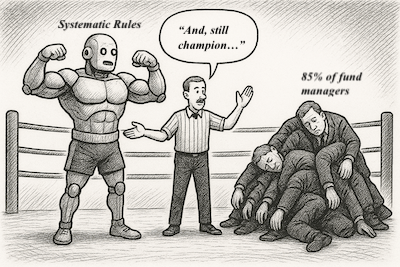

Tomorrow: Why professional managers consistently underperform systematic approaches.

Discover how to use historical analysis systematically. Read Wilfred Brockmann’s “The Future of Investing Is Here.”