Part of a multipart series on Busting Investment Myths

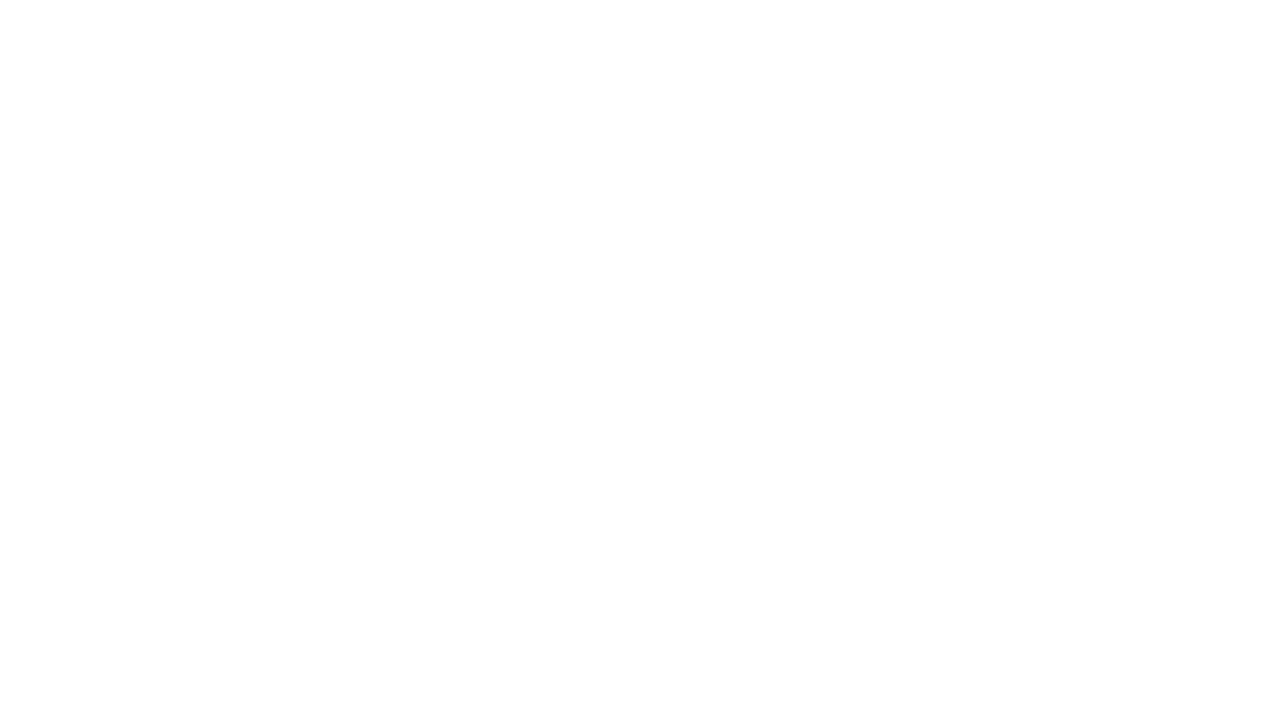

Investment management is a massive industry built on the premise that professional expertise adds value. Investors pay billions in fees annually for active management services, assuming that educated professionals with extensive resources can outperform systematic rules-based approaches.

The evidence suggests otherwise.

The Consistent Underperformance Data

SPIVA (S&P Indices Versus Active) reports track active manager performance against benchmarks. The results are devastating for the active management industry:

- Over 10-year periods, 85-90% of large-cap equity managers underperform the S&P 500

- The few managers who do outperform typically don’t sustain their advantage over subsequent periods

- After accounting for fees, taxes, and transaction costs, active management’s underperformance worsens

These aren’t cherry-picked statistics—they represent comprehensive analysis of the entire active management universe over multiple decades.

Why Smart People Consistently Fail

Professional managers aren’t failing due to lack of intelligence, education, or resources. They fail because active management faces structural obstacles that systematic approaches avoid:

Behavioral biases affect professionals too. Portfolio managers experience the same fear, greed, and overconfidence that hurt individual investors. Advanced degrees don’t eliminate emotional decision-making.

Career incentives conflict with optimal investing. Managers face pressure to avoid career-damaging mistakes rather than maximize long-term returns. This leads to conservative, benchmark-hugging strategies that can’t outperform after fees.

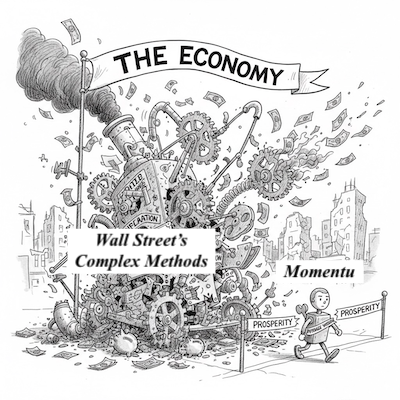

Information overload creates analysis paralysis. Access to extensive research and data doesn’t guarantee better decisions. Often, it creates conflicting signals that lead to indecision or overtrading.

Size limitations. Successful managers attract more assets, making it harder to deploy capital effectively in their best ideas. Large asset bases force diversification into mediocre opportunities.

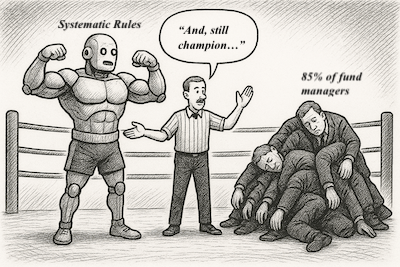

How Systematic Approaches Avoid These Traps

Emotion elimination: Rules-based systems make decisions based on predetermined criteria rather than current feelings or market sentiment.

Consistent execution: Systematic approaches apply the same logic to every decision without being influenced by recent results or external pressures.

Scalability: Well-designed systematic strategies can manage large amounts of capital without diluting their effectiveness.

Cost efficiency: Systematic approaches typically have lower costs than active management, improving net returns to investors.

The Professional Manager Paradox

The investment industry’s structure almost guarantees mediocre results. Managers who outperform attract assets that make continued outperformance harder. Those who underperform lose assets but rarely lose their jobs if they stay close to benchmark returns.

This creates an industry focused on asset gathering rather than performance generation.

The Systematic Alternative

The Brockmann Method’s 18-year backtest shows systematic momentum ranking outperforming both professional management and passive indexing. This isn’t due to superior intelligence or information—it’s due to consistent application of proven principles without emotional interference.

Professional management isn’t inherently flawed, but its current structure makes systematic approaches more likely to deliver superior long-term results.

Tomorrow: Why simple strategies consistently outperform complex ones.

Learn why systematic beats discretionary. Read “The Future of Investing Is Here” by Wilfred Brockmann.