Part of a multipart series on Busting Investment Myths

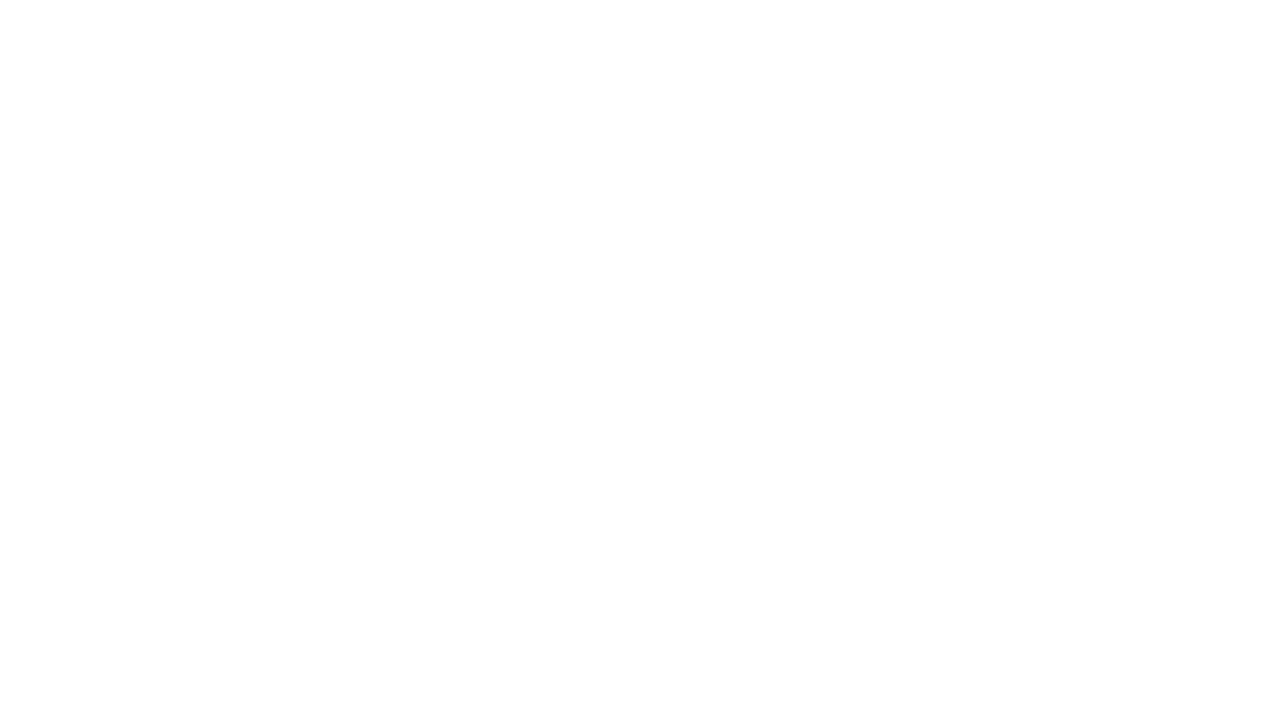

Wall Street sells complexity. Multi-factor models, derivative overlays, alternative risk premia, and quantitative optimization strategies dominate institutional investing. The implicit message is clear: sophisticated problems require sophisticated solutions.

This assumption is not only wrong—it’s expensive.

The Complexity Trap

Financial institutions have strong incentives to promote complex strategies:

Higher fees: Complex strategies justify higher management fees and advisory costs. A simple momentum strategy can’t command the same fee as a multi-factor alternative risk premia overlay.

Differentiation: In a crowded marketplace, complexity creates the illusion of unique value. Every manager needs a story that explains why their approach is different and superior.

Consultant appeal: Institutional consultants prefer complex strategies that require their expertise to evaluate. Simple strategies threaten their value proposition.

Psychological comfort: Complex strategies feel more scientific and professional, even when they don’t perform better than simple alternatives.

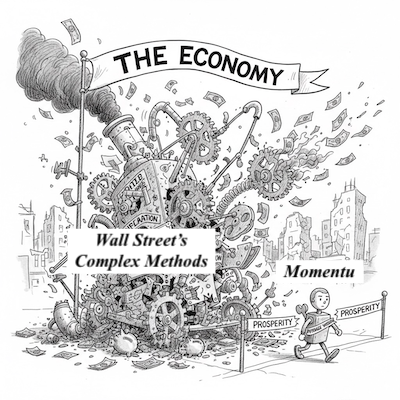

Why Simple Often Wins

Fewer failure points: Complex strategies have more components that can malfunction. Each additional factor, constraint, or optimization criterion creates another potential source of underperformance.

Reduced transaction costs: Simple strategies typically require fewer trades and adjustments, reducing implementation costs that can erode gross performance.

Easier to execute consistently: Complex strategies are harder to implement without errors. Simple rules-based approaches are less prone to execution mistakes.

More robust across different market conditions: Simple strategies that capture basic market phenomena tend to work across various market environments. Complex models often fail when markets behave differently than their historical training data.

The Academic Evidence

Research consistently shows that simple strategies often outperform complex ones:

- Single-factor momentum strategies often outperform multi-factor models

- Simple moving average crossovers compete effectively with sophisticated technical indicators

- Basic fundamental screens (low P/E, high dividend yield) often beat complex valuation models

- Equal-weighted portfolios frequently outperform optimization-weighted portfolios

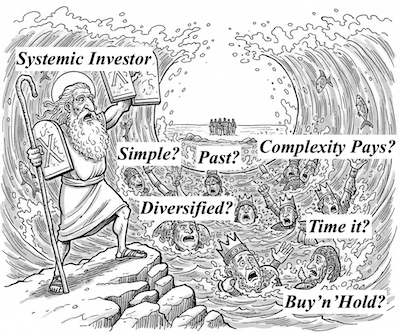

The Brockmann Method Example

Our approach intentionally embraces simplicity:

- Three zones instead of complex scoring systems

- Focus on momentum rather than multiple competing factors

- Clear rules that any investor can understand and follow

- Daily rankings without constant model adjustments

This simplicity isn’t due to lack of sophistication—it’s due to recognition that simple approaches often work better in practice.

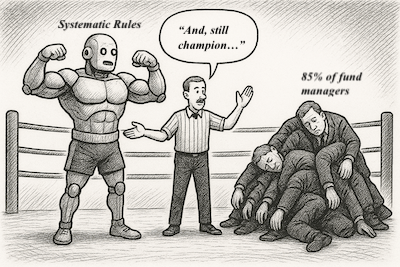

When Complexity Makes Sense

Complex strategies can add value in specific situations:

- Risk management for institutional portfolios with unique constraints

- Tax optimization for high-net-worth individuals

- Regulatory compliance requirements

- Custom solutions for unusual investor circumstances

But for most investors seeking market-beating returns, simple systematic approaches offer superior risk-adjusted performance at lower costs.

The Occam’s Razor Investment Principle

The simplest explanation that adequately explains observed phenomena is usually correct. In investing, simple strategies that capture basic market patterns often outperform complex models that try to optimize for too many variables simultaneously.

Tomorrow: The final post reveals what actually works in systematic investing.

Discover the power of systematic simplicity. Read “The Future of Investing Is Here” by Wilfred Brockmann.